Cashless insurance is a patient-friendly process, where the patient is treated in the hospital. The entire insurance process of the patient is taken care of by their insurance platform. Later the insurance company settles the claims directly with the hospital without the patient getting involved, making the process smoother and faster.

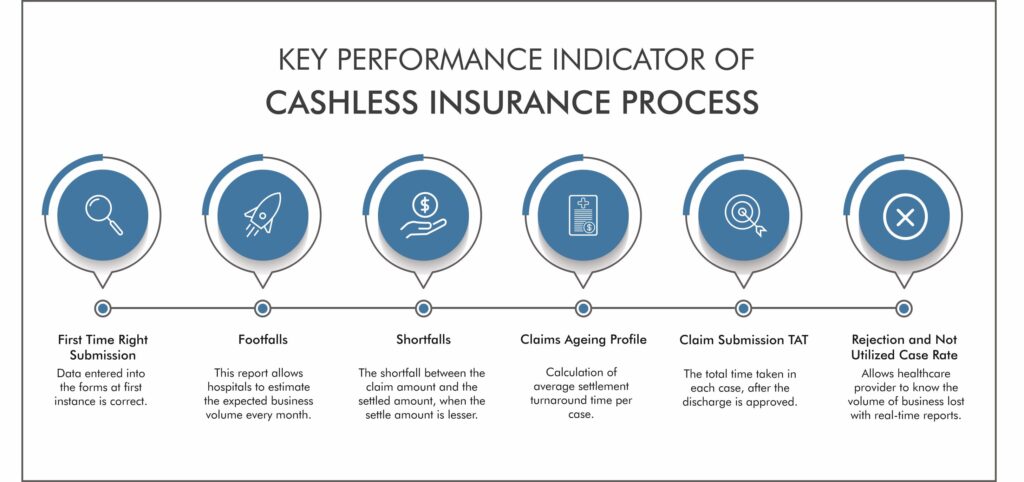

There are specific key performance indicators to be considered when deciding on the cashless insurance process product.

- First Time Right Submission: One of the significant features of FTRS for the cashless insurance process ensures that data enters into the forms at the first instance is correct. Thus, no errors can be introduced at any later stage and improve the turnaround time (TAT). Faster TAT means faster processing, which means more claims can be submitted and processed in lesser time.

- Footfalls: You can see the business volume you have conducted with each third-party administrator (TPA), and the management information system provides a complete footfall report. This enables better resource allocation and planning based on trends of peak days for cases. The footfall report allows hospitals to estimate the expected business volume every month.

- Shortfalls: A key component of any claim process is the shortfall between the claim amount and the settled amount when the settled amount is lesser. The right product will capture deductions, list the disallowance reasons, and enable a consolidated viewing of such cases. Each claim has its real-time reporting and analytics that gives you a 360-degree view of the entire system.

- Claims Ageing Profile: An RCM product requires an MIS, making it easy to view the average settlement turnaround time or TAT per case. With an analytics dashboard, it is easy to check settlements made and outstanding balances on a case by case basis to understand complex cases and solve them.

- Claim Submission TAT: The dashboard also requires to shows the time-around-time for claim submissions, the total time taken in each case, after the discharge is approved.

- Rejection & Not Utilized Case Rates: Case rates on rejections and non-utilized cases must be listed on the dashboard, with a breakup of individual cases. Allowing a healthcare provider to know how much business volume is lost and real-time reports make it pretty easy to understand the reasons for rejection and cancellation.

The cashless insurance process is eco-friendly and perfect for the pandemic’s current situation, where social distancing is the norm. These KPIs are an essential benchmark when looking for the right revenue cycle management product.

ABI Health’s Claimbook is India’s best RCM product, which provides all the above features. The easy integration of ClaimBook is its main USP. Administrators can correlate real-time admission data with the claims’ process to understand individual cases.

If you are looking for the best revenue cycle management software, then contact us for the demo.

Why Practice Social Distancing?

Amidst this lockdown, many are still asking the question about “Social Distancing”. As per the scientists, finding the cure or medicine for COVID-19 it may take about 12-18 months to find it. Hence. To prevent the spreading of this virus social distancing is the most effective way to do it.

Let's start by explaining what is social distancing, it is a conscious and deliberate choice of maintaining the distance of six feet from the people around us, to prevent the spreading of COVID-19.

To understand better the impact of it, here is a small visual to explain how the virus will spread if social distancing is not paid attention.

Social distancing is so effective right now that as an individual we all are contributing in the prevention of spreading this deadly virus.

There is another major concern that is coming into the picture with the rapid increase in the coronavirus patients. Hospitals around the world do not have enough resources to tackle this pandemic, there are limited numbers of healthcare facility in all the countries around the world.

The coronavirus outbreak in Italy has shown, the faster rate of the population getting infected by it and to tackle with it, there are not enough medical resources like hospital beds, ventilators and doctors. This will be challenging for the healthcare to save lives leading to exponential rise in number of deaths.

Hence, social distancing is the most effective way to "flatten the curve" or reduce the spread of this coronavirus.

What does flattening the curve means?

The researchers have projected a graph to understand the impact of the spreading of coronavirus against the number of hospital beds. Though this is a theoretical graph, it does show how quickly the capacity of healthcare can come crashing down which can make COVID-19 an epidemic, hard to deal with.

This curve indicates, if the same number of people are getting at a slower rate over a longer period of time, then it reduces the pressure on the healthcare system and making it easier to treat everyone, hence, a lesser number of deaths.

Therefore, just by taking small measures individually, like maintaining social distance, washing hands frequently, avoid going out in crowded places, and spend maximum time inside the house. We all can contribute a collective to fight against this deadly coronavirus.